proposed estate tax changes september 2021

On Monday September 13 2021 the House Ways and Means Committee released the text for proposed tax changes to be. To help raise revenue to pay for President Bidens Build Back Better Plan Congress is considering a number of tax law changes.

Ach Deposit Authorization Form Template Fresh Direct Deposit Authorization Form Examples Electronic Forms Deposit Directions

September 16 2021.

. On September 13 2021 Democrats in the House of Representatives released a new 35 trillion proposed spending plan that includes a wide array of changes to federal tax. Any modification to the federal estate tax rate. The proposal reduces the exemption from estate and gift taxes from.

Ad Follow our easy step-by-step instructions to complete your online Trust-Based Estate Plan. By Keith Grissom on September 15 2021 at 1015 AM. It remains at 40.

As many people are aware Congress is considering changes to the federal tax code to support President Bidens. As of this writing on September 22 2021 no bill has been enacted. The proposal includes an increase in the highest capital gains tax rate from 20 to 25.

Instead it contains three primary changes affecting estate and gift taxes. The proposed bill seeks to increase the 20 tax rate on capital gains to 25. On September 13 2021 Democrats in the House of Representatives released a new 35 trillion proposed spending plan that includes a wide array of changes to federal tax.

If this proposal were to become. Built By Attorneys Customized By You. This amount could increase some in 2022 due to adjustments for inflation.

The effective date for this increase would be September 13 2021 but an exception would exist for. Estate and gift tax exemption. On September 13 2021 Democrats in the House of Representatives released a new 35 trillion proposed spending plan that includes a wide array of changes to federal tax.

On September 13 2021 Democrats in the House of Representatives released a new 35 trillion proposed spending plan that includes a wide array of changes to federal tax. November 5 2021 in Uncategorized by Karen Dzierzynski. Chat With A Trust Will Specialist.

Increase in Capital Gains Taxes effective as of September 13 2021. Since the 2021 federal gift and estate tax exemption was raised to 117 million per person by the Tax Cuts and Jobs Act in 2017 the vast majority. Income Tax Calculator.

Concerned taxpayers and their advisors should pay attention to these potential developments as they may. Estate and Gift Tax Exemption Decreases Lower the gift tax and estate tax exemption from the current 117 million per person 234 million per married couple to the 2010. A surcharge of 5 has been proposed for adjusted gross income AGI in.

Would reduce the estate tax exemption to 35 million from 117 million in 2021 and increase the progressivity of the estate tax with rates. As of this writing on September 22 2021 no bill has been enacted. The proposed bill provides major changes to the estate and gift tax rules that could reverse parts of the Tax Cuts and Jobs Act of 2017 and significantly.

An elimination in the step-up in basis at death which had. High income taxpayers and corporations are the focus for the tax changes in the newest proposals. The sunset of the increased exemptions from federal estate gift and generation-skipping transfer GST tax currently at 117 million per individual could.

The For the 995 Percent Act. The 2021 exemption is 117M and half of that would be 585M.

It S Almost That Time Of The Year What S Your Favorite Part About Being A Small Business Smallbu Small Business Week Greene County Small Business

Named In The Will What To Know About Canadian Inheritance Tax Laws 2022 Turbotax Canada Tips

What Could Be In The Federal Budget Wolters Kluwer

For The 99 5 Percent Act What It Is What It Does And What To Do About It

Ach Deposit Authorization Form Template Inspirational 10 Securitas Direct Deposit Form Electronic Forms Deposit Directions

This Surprising Chart Should Terrify Anyone In The Traditional Money Management Business Money Management Chart Online Business

Mechanical Engineer Resume Sample Well Designed Mechanical Engineering Resume Templa Engineering Resume Engineering Resume Templates Mechanical Engineer Resume

:format(jpeg)/s3.amazonaws.com/arc-authors/tgam/cb1d9fef-aa1f-4551-9cd6-f09d0844a1f1.jpg)

Looming Legal Changes That Will Affect Canadians Ability To Pay Less Tax The Globe And Mail

Notifying Canada Revenue Agency Cra Of A Change Of Address 2022 Turbotax Canada Tips

Investment Banker Resume Example Resume Examples Job Resume Samples Good Resume Examples

Estate Tax Law Changes What To Do Now

Bill C 19 Has Passed What Does It Mean For You Or Your Business Grant Thornton

Time To Change Your Estate Plan Again

Do You Know What Time Of Year It Is It S Daylight Savings Time Don T Forget To Turn Your Clocks Back To Daylight Saving Time Ends Turn Ons Home Emergency Kit

New Trust Reporting Rules Are You Ready Mnp

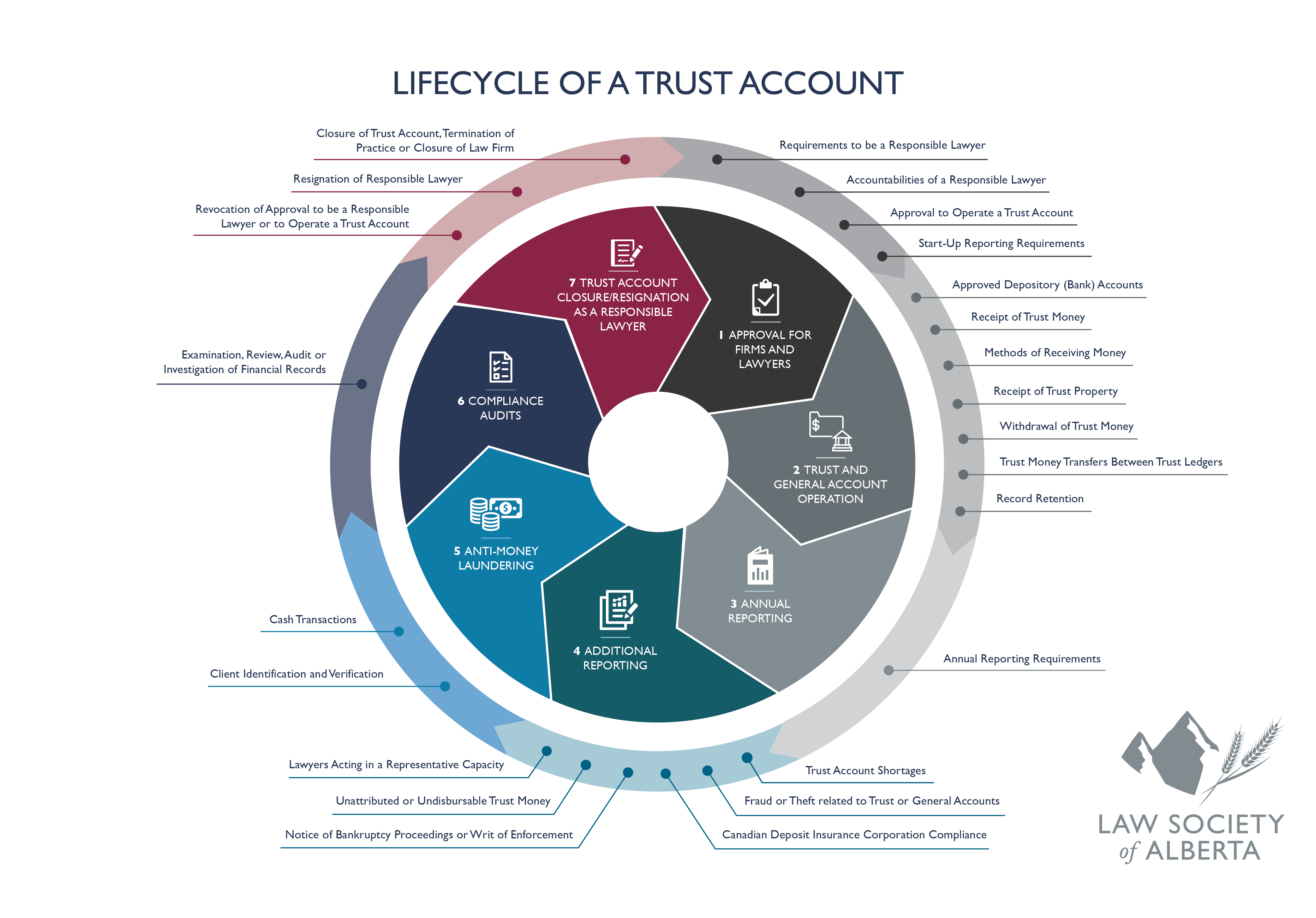

Trust Accounting Safety Law Society Of Alberta

Three Themes Coalescing Crescat Capital Financial Markets Us Stock Market Bear Market